While supermarkets continue to struggle for sales growth, one promising niche opportunity identified in a recent Nielsen report has been the $1.1 billion "on-the-go" snacking subcategory of the $16.3 billion "snackable" fruit and vegetable category. In fact, on-the-go has registered growth greater than 10% every year between 2012 and 2016, with no sign of slowing.

In case you are wondering, Nielsen describes the on-the-go snacking subcategory as including "items that are intended for individual consumption in a single sitting, such as individual-sized cut fruit or vegetables, dried fruit, and nut snack packs, fresh smoothies (16 oz. and below) and fruit cups."

On-the-go is an area where retailers can differentiate themselves from the competition, notes United Freshfacts® in its Q2 2017 report. It indicates that many underrepresented fruits and vegetables have not fully benefited from the snack-sized product trend in terms of assortment and promotion. Additionally, there is room for overall demand to grow. Only one-third of domestic households purchased on-the-go snacking produce in the last year, doing so 3.1 times per year on average.

Concerning products within the on-the-go subcategory, fresh fruit is the driving force, registering 44% of sales versus 27% for fresh smoothies, 17% for snacking vegetables, 7% for dried fruit/nut snacks, and 5% for fruit cups. In fact, fresh fruit on-the-go increased by 17% over the last year to lead sub-category growth (fruit cups were the laggard with a drop of 10% in sales), but Nielsen emphasizes that there were four times as many fresh fruit items as vegetable items to choose from in the sub-category—an explanation for the rapid fresh fruit growth. The underlying observation is that there should be opportunities for vegetables to generate more sales if a larger shelf presence is established.

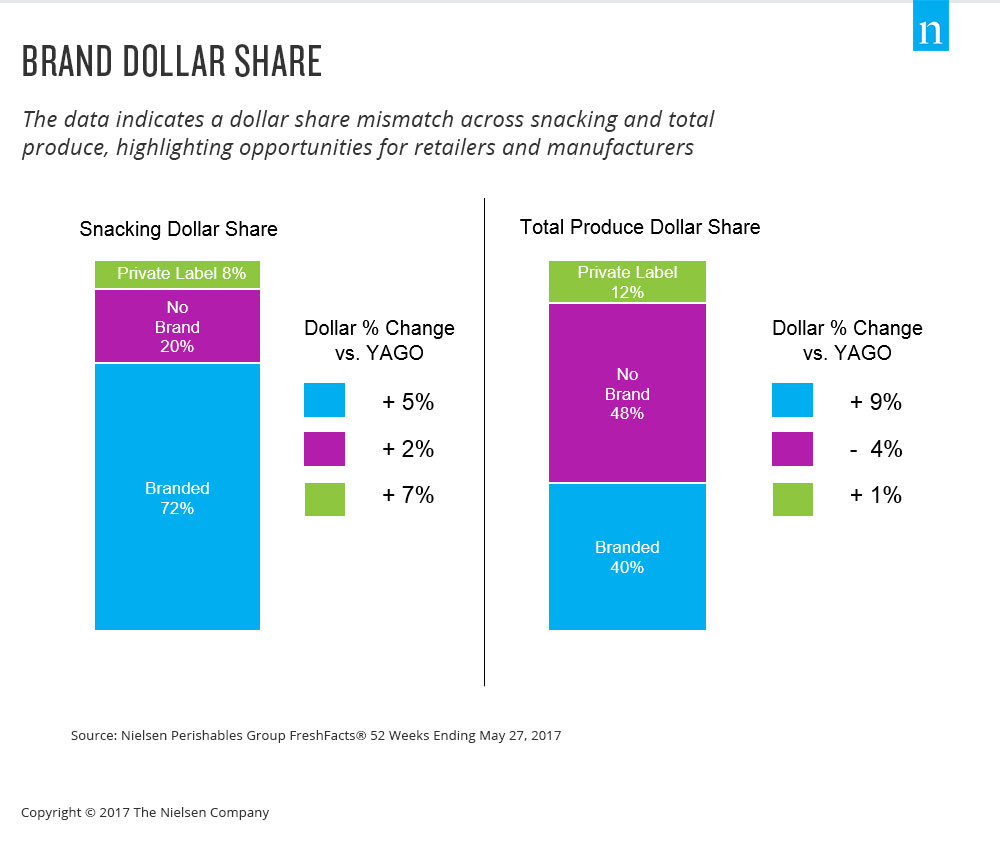

Also, noteworthy from the Nielsen report is the under-representation of unbranded and private label across snacking, shown above. It suggests that this situation represents a "possible opportunity to produce options in-house to build market share and sales."

When it comes to making the most of the on-the-go niche, Nielsen offers the following suggestions. Firstly, it emphasizes the importance of variety and options. "Healthful snacking transcends all retail outlets and can serve as a key point of differentiation within the produce department," Nielsen states. Secondly, the report suggests that manufacturers should keep a watch for "potential mismatches between snacking and produce consumption trends" such as the private label and unbranded variances noted above. Where trends between produce snacking and overall produce sales deviate, there may be untapped opportunities to expand offerings and increase sales.

Ultimately, Nielsen concludes, consumers have a "myriad options" when it comes to selecting snack foods. While fresh produce items are crucial, many fruits and vegetables are still not offered as on-the-go options. Nielsen’s analysis emphasizes that understanding "who, how, where and why shoppers choose different items for snacking can help uncover new opportunities for distribution, innovation, and marketing to ensure success on an already crowded shelf."

Stay up to date

Want the latest fresh food packaging industry knowledge delivered straight to your inbox? Subscribe to our newsletter and get the latest news, trends, articles and more!